money doesn’t grow on trees

Raising capital for your technology business is a tough gig. For most, just finding investors who are interested in taking a serious look at your company is hard work. But even once you have investors that you like on the hook, there is still a big hill to climb before the money hits your bank account.

where we come in

Our job is to help you negotiate a good term sheet, get through the slog of completing long form documents, and satisfy investor conditions with your sanity intact. It’s a job we are good at – we did 146 deals in 2020 alone.

read more about our 2020 capital raising numbers

getting ready for your capital raise

As well as helping companies get investment ready, we help founders and their teams to develop their capital raising strategy, including answering common questions e.g. what types of investors will be interested in our company? What sort of investment structure will they want? What rights will they require?

capital raising basics: getting investment ready

capital raising basics: investment mechanics and terms

agreeing terms

Because we see a large number of deals, we can provide useful behind the scenes input to companies as they negotiate headline terms with investors, including on investment amounts and pre-money valuations.

Once the big-ticket items are agreed, we help companies negotiate the term sheet. The key economic and control terms are recorded in the term sheet, making it the most important phase of an investment deal.

There’s often an imbalance of knowledge between first-time founders and repeat players like VCs and other investors. We can help you level the playing field.

formal documents

The style and friendliness of investment documents varies widely depending on the type of investor.

We draft and negotiate all of the types of documents used by seed, angel, VC, corporate, venture debt, private equity and pre-IPO investors. We’ve seen so many of these that we know the negotiating parameters that investors are likely to bring to the negotiation table and we share this knowledge with our clients.

We also promote better investment documentation and practices to founder and investor communities.

investors

We also act for a number of high net worth and venture capital investors.

“When you work with a range of investors on a global deal, you need a legal partner who can get the deal done. Kindrik Partners provided the best advice which got us a big outcome.”

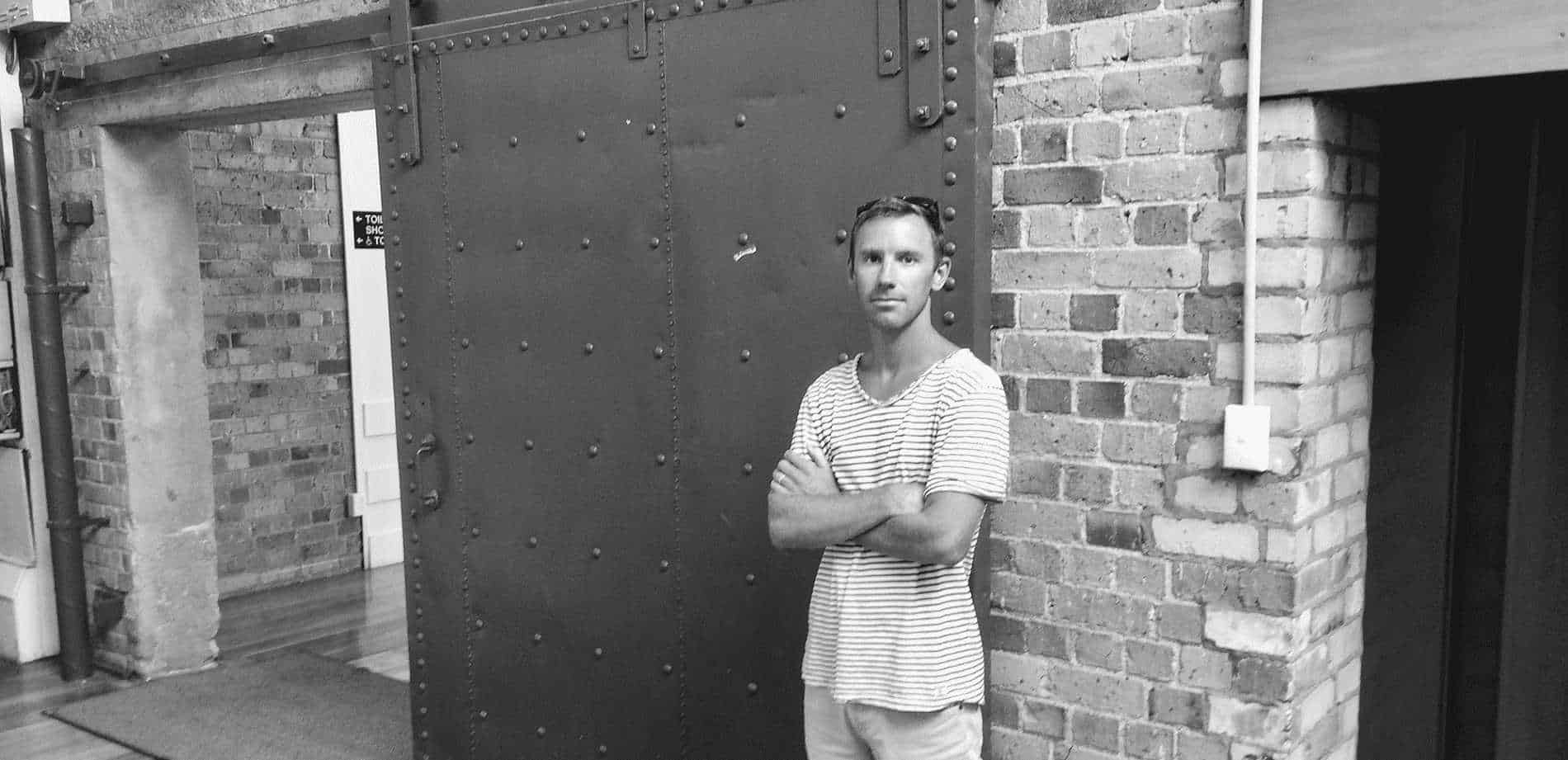

tim norton, founder, 90 seconds

capital raising resources

How to deal with a rolling close in your startup investment documents

economic downturn and startup term sheets

The global economic downturn has inevitably hit the startup and venture capital ecosystem. Investors in startups, like everyone else, are impacted by falling stock prices and fund valuations, distracted from…

tranches in investments: what you need to know

Occasionally investors request that their investment amount be paid in tranches (ie split into portions). This guide covers why you should be wary.

subscribe to our newsletter and get the latest templates and tips for fast-growing startups in New Zealand

read our capital raising case studies

shuttlerock

Shuttlerock developed a SaaS platform to help brands collect content and use it in online video advertisements. Read more about how they closed their round of ~$1.6m in late 2017.

jude

Jude was created by New Zealand fintech company Jude Limited to automatically handle those routine but easily overlooked parts of managing your bank accounts. Read about their seed round with Ice Angels.

nyriad

Software company Nyriad has developed an ultrafast, low-power GPU-based storage solution, and recently closed a series A capital raise, with Kindrik Partners handling the legals.